Cross-chain

Learn how Pyth prices move from Pythnet to target blockchains

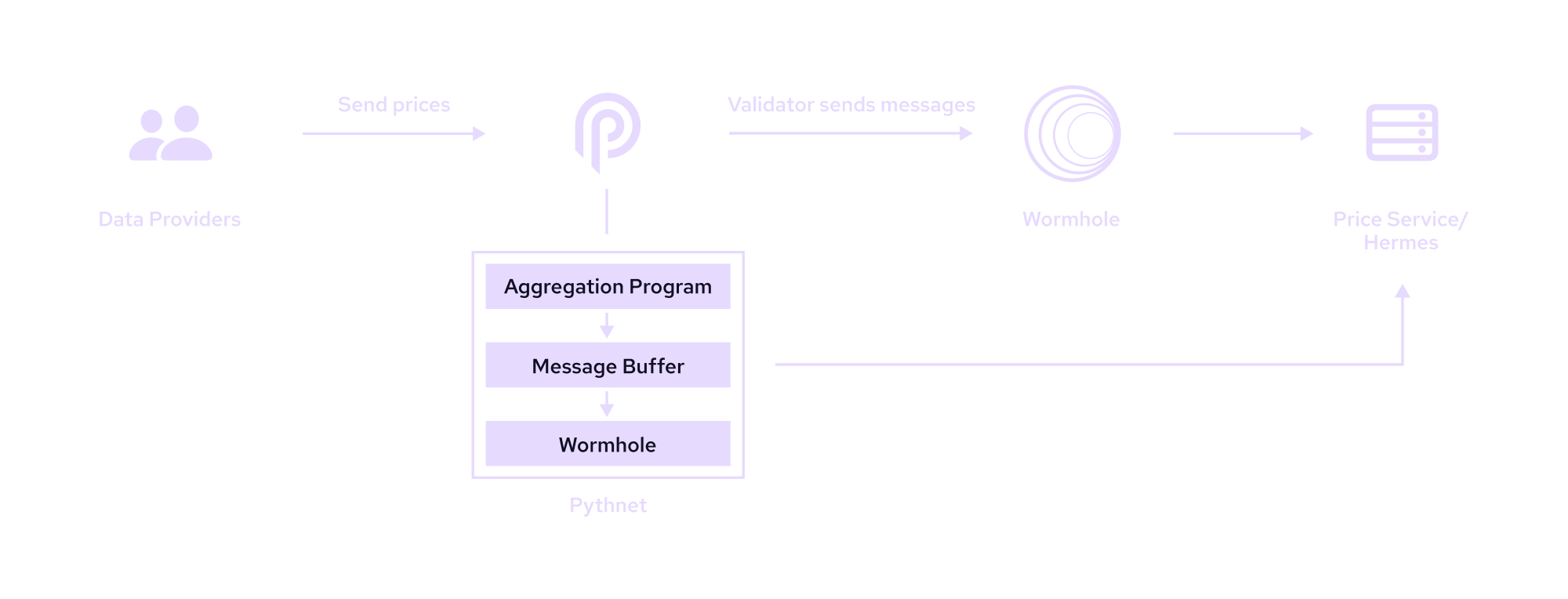

Pyth uses a cross-chain mechanism to transfer prices from Pythnet to target chains. The diagram below shows how prices are delivered from Pythnet to target chains:

Data providers publish their prices on Pythnet. The on-chain oracle program then aggregates prices for a feed to obtain the aggregate price and confidence. Next, the Pythnet validators send a Wormhole message on each Pythnet slot to the Wormhole contract on Pythnet containing the Merkle root of all the prices. Wormhole guardians then observe the Merkle root message and create a signed VAA for the Merkle root message.

Hermes continually listens to Wormhole for Pyth Merkle roots at each slot. It also listens to Pythnet to get all the price messages. It stores the latest price messages with their Merkle proof and signed Merkle root in memory and exposes HTTP and server-side streaming APIs for retrieving the latest update. (Anyone can run an instance of this webservice, but the Pyth Data Association runs a public instance for convenience.) When a user wants to use a Pyth price in a transaction, they retrieve the latest update message from Hermes and submit it in their transaction. The update message includes the signed Merkle tree root, along with the Merkle proofs of each included price update. To verify the payload, the Pyth Network contract simply checks the Wormhole signatures on the root, then checks the Merkle proofs and, if it is valid, stores the new price in its on-chain storage.

Finally, on-chain protocols integrate with the Pyth contract via a simple API that retrieves the current Pyth price from its on-chain storage. This API will return the current price as long as it has been updated sufficiently recently; this approach works because users will have updated the Pyth price earlier in the same transaction. Protocols can configure the recency threshold to suit their needs — e.g., latency sensitive applications can set a lower threshold than the default.